25, 2023

2023;

4.750,000;

5. and

By order of the Board of Directors, | |||||

/s/ | |||||

| |||||

Chief Financial Officer | |||||

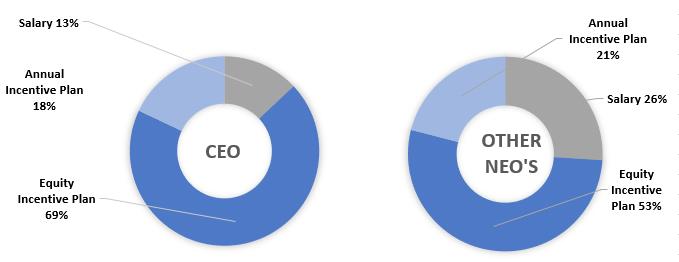

10, 2023 ATRICURE, INC. 25, 2023 the What if I want to revoke and change my vote? How are “broker non-votes” counted? 5. What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors? to cfo@atricure.com or: many important contributions during his 14 year tenure. Committee Membership+ Name Age Director Since Independent Audit Compensation Compliance, Quality, and Risk Nominating and Corporate Governance Strategy Michael H. Carrel 49 2012 No Mark A. Collar 67 2008 Yes X C Scott W. Drake 52 2013 Yes X Daniel P. Florin 55 2019 Yes X* X Regina E. Groves 61 2017 Yes C X B. Kristine Johnson 68 2017 Yes X X X Mark R. Lanning 65 2006 Yes X* C Karen N. Prange 56 2019 Yes X X Sven A. Wehrwein 69 2016 Yes C* X Robert S. White 58 2013 Yes X X C 2019 Meetings 5 6 6 4 4 rules. re-enter the catheter-based Afib ablation market and achieved the goal to be market leader in paroxysmal, or intermittent, Afib ablation. Additionally, Ms. Groves successfully acquired and integrated companies, completed numerous clinical trials and launched novel products in the United States and worldwide. Prior to this, she was the Vice President of Quality and Regulatory for Medtronic’s Cardiac Rhythm Disease Management (CRDM) business from 2006 to 2008 and before that was Vice President and General Manager for Patient Management CRDM at Medtronic from 2002 to 2006. Ms. Groves holds a B.S. in Pharmacy from the University of Florida and an M.B.A. from Harvard Graduate School of Business Administration. qualifies as an “audit committee financial expert” under SEC rules. medical technology. General Counsel for Gilead Sciences, Inc., a leading biopharmaceutical company. Ms. Telman is responsible for Gilead’s legal and corporate affairs function, which includes government and policy, and public affairs, and she additionally serves as the Corporate Secretary of Gilead. Prior to Gilead, Ms. Telman was Executive Vice President and General Counsel for Organon & Co., a global healthcare company formed in March 2021 through a spin off from Merck to focus on improving the health of women throughout their lives. Ms. Telman helped lead the separation work that created a standalone company serving more than 140 markets with more than 60 medicines and products across a range of therapeutic areas. Before Organon, Ms. Telman was General Counsel at Sorrento Therapeutics from 2018 to 2020, where she was responsible for mergers and acquisitions, licensing, governance, finance, human resources, regulatory compliance and legal functions. Previously, she spent four years at Johnson Controls International plc as Vice President and General Counsel - Building Solutions, North America, and prior to that she held executive roles at Abbott Laboratories and The Boeing Company, and was a partner at Winston and Strawn LLP. Ms. Telman received her B.A. in Mathematics from the University of Pennsylvania and J.D. from Boston University School of Law. experience as a certified public accountant (inactive), investment banker to emerging-growth companies, chief financial officer and audit committee and board chair. Mr. Wehrwein currently serves as MBA from Case Western Reserve University. and Diversity Directors helps to set the “tone at the top” for our DE&I initiatives. Committee evaluates such factors, among others, and does not assign any particular weighting or priority to any of these factors nor does the Committee have a formal policy with respect to diversity. Candidates properly recommended by stockholders are evaluated by the independent directors using the same criteria as other candidates. Board of Directors Demographics Independence Independent Non-independent Gender Diversity Men Women Age < 55 years 56 - 60 years 61 -70 years Tenure < 5 years 5-10 years > 10 years Diverse Range of Qualifications and Skills Represented by Our Nominees Mergers & Acquisitions Atrial Fibrillation Sales & Marketing Service on Public Boards CEO Experience Finance & SOX Compliance Risk Management Medical Payment & Reimbursement Medical Devices NASDAQ. Committee Chair Retainer(1) Membership Retainer Audit $ $ Compensation Compliance, Quality and Risk Nominating and Corporate Governance Strategy Name Fees Earned Stock Awards ($)(1)(2) Total ($) Mark A. Collar $ $ $ Scott W. Drake Daniel P. Florin Regina E. Groves B. Kristine Johnson Mark R. Lanning Karen N. Prange Sven A. Wehrwein Robert S. White Name Outstanding Stock Awards (#) Outstanding Option Awards (#) Mark A. Collar Scott W. Drake Daniel P. Florin — Regina E. Groves — B. Kristine Johnson — Mark R. Lanning Karen N. Prange — Sven A. Wehrwein Robert S. White Code of Conduct AtriCure is also a member of MedTech Europe, a voluntary trade association for the medical technology industry including diagnostics, medical devices and digital health. MedTech Europe and its members are committed to a high level of ethical business practices and have put in place strict guidelines to advise medical technology manufacturers on how to collaborate ethically with healthcare professionals (HCPs). It covers medical education and research and development. It also introduces an independent Our Board committees Michael H. Carrel President, Chief Executive Officer and Director Mark A. Director Regina E. Groves Director Karen N. Prange Director Deborah H. Telman Director Robert S. White Director 45 Chief Financial Officer Karl S. Dahlquist, J.D., C.C.E.P. Salvatore Privitera, Chief Technical Officer Douglas J. Seith Chief Operating Officer Ph.D. from North Dakota State University. Service Category 2019 2018 Audit Fees $ $ Audit-Related Fees Tax Fees — — All Other Fees — Total $ $ 2022. 2023. (“2023 Stock Incentive Plan”). Based on the recommendation of the Compensation Committee, the Board and to establish, amend, suspend or waive any rules and regulations relating to the 2023 Stock Incentive Plan. The her own independent tax advisor. Name and Position Restricted Performance Awards (1) Restricted Stock Units Michael H. Carrel — Justin J. Noznesky — Salvatore Privitera Chief Technical Officer — Douglas J. Seith — M. Andrew Wade Chief Financial Officer — Executive Group — Non-Executive Director Group — — Non-Executive Officer Employee Group — year. Number of securities to be Weighted average exercise Number of securities Plan category (a) (b) (c) Equity compensation plans approved $ Equity compensation plans not approved — — — Total $ 2022. advisor. Beneficial Ownership Beneficial Owner Shares Options Percent Holders of More Than 5% FMR LLC (1) — % BlackRock, Inc. (2) — % Wellington Management Group LLP (3) — % Named Executive Officers Michael H. Carrel % M. Andrew Wade * Justin J. Noznesky * Salvatore Privitera — * Douglas J. Seith — * Directors and Nominees Mark A. Collar * Scott W. Drake * Daniel P. Florin — * Regina E. Groves — * B. Kristine Johnson — * Mark R. Lanning * Karen N. Prange — * Sven A. Wehrwein * Robert S. White * All executive officers and directors as a group (17 persons) % 9, 2023. 3, 2023. Beneficial Owner Stock Ownership Guideline Chief Executive Officer > Specified Officers other than Chief Executive Officer > 1x annual base salary Non-employee directors > 3x annual cash retainer* Compensation Philosophy and Objectives What AtriCure Does ✓ A significant portion of executive pay is not guaranteed, but rather is at-risk and tied to the achievement of various performance metrics that are disclosed to ✓ The Company generally considers NEO salaries as part of its annual performance review process in an effort to be responsive to industry trends. ✓ The incentive programs provide an appropriate balance of annual and longer-term incentives, with long-term incentive compensation comprising a substantial percentage of target total compensation. ✓ These mitigate the risk of the undue influence of a single metric by utilizing multiple performance measures for annual incentive ✓ Amounts of payments under the ✓ Target compensation for NEOs is set after consideration of market data on compensation at other medical device and life science companies. ✓ The Company maintains change in control agreements with certain of its NEOs, which require termination during a change in control period for severance payments to occur. ✓ The Company has the following minimum stock ownership requirements: CEO – ✓ Awards issued pursuant to ✓ The Committee regularly evaluates the Company’s compensation policies and practices, or components thereof, for risks that are reasonably likely to have a material adverse effect on the Company. ✓ The Committee consists entirely of independent directors. ✓ The Company considers the say-on-pay vote and discusses its compensation practices with investors. What AtriCure Does Not Do x The Company has not entered into any new contractual agreements that include excise tax gross-up payments. x The Company has never repriced or otherwise reduced the per-share exercise price of any outstanding stock options. Repricing of stock options is not permitted under x The Company’s insider trading policy prohibits directors and executive officers from entering into hedging transactions with respect to the Company’s securities and from holding the Company’s securities in margin accounts or otherwise pledging such securities as collateral for loans. No directors or executive officers have in place any pledges or hedging transactions. x The Company does not provide executives with programs that are not made available to all Company employees, except in extremely limited circumstances. x We do not offer pension arrangements or retirement plans or arrangements to our Executive Compensation Program and Process philosophy. As part of the executive competitive pay assessment, ABIOMED, Inc. STAAR Surgical Company Cardiovascular Systems, Inc. Tandem Diabetes Care, Inc. proxy statement. Elements of Executive Compensation Element Philosophy Objective Form Type Performance Criteria Base Salary To attract, Cash Fixed Continued service Annual incentive bonus To compensate executives based upon the value of their individual and collective contributions to achieving corporate goals and objectives Cash Variable Pre-established performance metrics based on achievement of operational, financial and strategic Equity incentive awards To align the interests of our executives with those of our stockholders who intend to stay invested over a multi-year period Variable The realizable value of restricted stock awards is linked to the Company’s stock price after the grant date. Performance share awards are not earned unless specific levels of Company performance are achieved. Vesting periods are Executive Officer 2018 Salary 2019 Salary % Increase Michael H. Carrel $ $ % M. Andrew Wade Justin J. Noznesky Salvatore Privitera Douglas J. Seith Salary levels are generally considered annually as part of our annual performance review process, as well as upon a promotion or other change in job responsibility. Salary guidelines are set each year to reflect our industry’s competitive environment, balanced by the desire to control the overall cost of salaries and wages, as well as consistency with our annual employee merit increase guidelines. The Compensation Committee set target objectives that the Committee Objectives Maximum Target Threshold for Entry Weight Actual Results Achievement Payout Factor Payout Range 200% 100% 50% Worldwide Revenue Growth(1) 16% 12% 10% 60% 13.8% 146.0% 87.6% Worldwide Gross Margin(1) 75% 74% 73% 10% 74.4% 140.0% 14.0% Functional Objectives(2) 15 goals 10 goals 8 goals 30% 12 goals 140.0% 42.0% very difficult. Executive Officer Base Salary Percentage of Percentage of Percentage of Target Michael H. Carrel $ % % % $ M. Andrew Wade Justin J. Noznesky Salvatore Privitera Douglas J. Seith Executive Officer Base Salary Percentage of Amount of Michael H. Carrel $ % $ M. Andrew Wade Justin J. Noznesky Salvatore Privitera Douglas J. Seith 3. Equity Incentive Awards. We issue equity awards to our executive officers and employees under our and each individual’s current equity position. We believe that share-based awards will stimulate pride in ownership and motivate employees and executives to commit themselves to our performance and increasing stockholder value. Estimated Possible Payouts Stock Grant Date Executive Officer Grant Threshold Target Maximum Units Awards Michael H. Carrel PSAs 3/1/2019 $ RSAs 3/1/2019 $ M. Andrew Wade PSAs 3/1/2019 $ RSAs 3/1/2019 $ Justin J. Noznesky PSAs 3/1/2019 $ RSAs 3/1/2019 $ Salvatore Privitera PSAs 3/1/2019 $ RSAs 3/1/2019 $ Douglas J. Seith PSAs 3/1/2019 $ RSAs 3/1/2019 $ The Compensation Committee continually reviews the value and mix of equity awards granted to executive officers in light of equity awards at peer group awards and performance share awards with revenue CAGR performance conditions for awards granted on March 1, 2022 and June 1, 2022 was $69.59 and $39.94, respectively, while fair value of performance share awards with the TSR market condition for awards granted on March 1, 2022 and June 1, 2022 was $139.32 and $61.28, respectively. The Company also regularly engages with investors regarding the performance metrics that are most important. Based on this engagement, beginning in 2021 the long-term performance share awards also utilize total shareholder return (TSR) as a market metric. standards of NASDAQ listing standards. The Compensation Committee adopted a policy that states that NEOs of the Company will not be reimbursed by the Company for personal taxes owed by them resulting from their receipt of perquisites, other than for relocation expenses. Salary Stock Awards Option Awards Non-Equity All Other Total Name and Position Year ($) ($) (1) ($) (2) ($) (3) ($) (4) ($) Michael H. Carrel 2019 $ $ $ — $ $ (5) $ President and Chief 2018 — (5) Executive Officer 2017 — (5) M. Andrew Wade 2019 — Chief Financial Officer 2018 — 2017 — Justin J. Noznesky 2019 — Senior Vice President, 2018 — Marketing and Business 2017 — Development Salvatore Privitera 2019 — Chief Technical Officer (6) 2018 — 2017 — — Douglas J. Seith 2019 — (7) Chief Operating Officer 2018 — (7) 2017 — (7) Executive Officer Granted in Michael H. Carrel $ Douglas J. Seith 2020. Plan and other amounts as noted. $750,000. The PSAs vest after the end of a three-year performance measurement period, subject to the terms and conditions of our standard PSA agreement, including the satisfaction of the performance goals therein, and the 2014 Plan. Estimated Possible Payouts Estimated Possible Payouts Stock Grant Date Executive Officer Grant Threshold Target Maximum Threshold Target Maximum Units Awards ($) Michael H. Carrel $ $ $ PSAs 3/1/2019 $ RSAs 3/1/2019 $ M. Andrew Wade PSAs 3/1/2019 $ RSAs 3/1/2019 $ Justin J. Noznesky PSAs 3/1/2019 $ RSAs 3/1/2019 $ Salvatore Privitera PSAs 3/1/2019 $ RSAs 3/1/2019 $ Douglas J. Seith PSAs 3/1/2019 $ RSAs 3/1/2019 $ Outstanding Equity Awards at Fiscal Year-End Option Awards (2) Stock Awards(3) Performance Share Awards(4) Number of Securities Underlying Unexercised Options (#) Shares or Units of Stock That Have Not Vested Equity Incentive Plan Awards: Unearned Shares, Units or Other Rights That Have Not Vested Executive Officer Award Date Exercisable Unexercisable Price Expiration Number (#) Market Value ($)(1) Number (#) Market or Payout Value ($)(1) Michael H. Carrel 11/1/2012 $ 11/1/2022 — — — — 11/1/2012 — 11/1/2022 — — — — 1/24/2014 1/24/2024 — — — — 1/24/2014 — 1/24/2024 — — — — 3/1/2016 — — — — — — 3/1/2017 — — — — — — 3/1/2018 — — — — 3/1/2019 — — — — M. Andrew Wade 10/25/2012 — 10/25/2022 — — — — 12/27/2012 — 12/27/2022 — — — — 1/24/2014 — 1/24/2024 — — — — 3/1/2016 — — — — — — 3/1/2017 — — — — — — 3/1/2018 — — — — 3/1/2019 — — — — Justin J. Noznesky 1/6/2014 — 1/6/2024 — — — — 3/1/2016 — — — — — — 3/1/2017 — — — — — — 3/1/2018 — — — — 3/1/2019 — — — — Salvatore Privitera 7/24/2017 — — — — — — 3/1/2018 — — — — 3/1/2019 — — — — Douglas J. Seith 12/27/2012 — �� 12/27/2022 — — — — 1/24/2012 — 1/24/2024 — — — — 3/1/2016 — — — — — — 3/1/2017 — — — — — — 3/1/2018 — — — — 3/1/2019 granted in 2021 and 2022. Option Awards Stock Awards Executive Officer Number of Value Number of Value Michael H. Carrel $ $ M. Andrew Wade Justin J. Noznesky Salvatore Privitera — — Douglas J. Seith — — exercise. Name Payments Aggregate Aggregate Other Michael H. Carrel $ $ $ $ M. Andrew Wade — Justin J. Noznesky — Salvatore Privitera — — Douglas J. Seith — charter document and provides for the advancement of expenses. The Company intends to enter into indemnification agreements with any new directors and executive officers in the future. Consistent with the disclosure instructions of Item 402(u) of Regulation S-K, the applicable SEC rule, we may identify our median employee for purposes of providing pay ratio disclosure once every three years and calculate and disclose total compensation for that employee each year; provided that during the last completed fiscal year, there has been no change in the employee population or employee compensation arrangements that we reasonably believe would result in a significant change. Under the SEC’s rules and guidance, there are numerous ways to determine the compensation of a company’s median employee, including the employee population sampled, the elements of pay and benefits used, any assumptions made and the use of statistical sampling. In addition, no two companies have identical employee populations or compensation programs, and pay, benefits and retirement plans may differ by country even within the same company. As such, our pay ratio may not be comparable to the pay ratio reported by other companies. We are not aware of any other business to be presented at the Annual Meeting. As of the date of this proxy statement, no stockholder had advised us of the intent to present any business at the Annual Meeting. Accordingly, the only business that our Board intends to present is as set forth in this proxy statement. /s/ Chief Financial Officer The Performance Compensation Award granted under the Plan. For purposes of Section 5(c) of the Plan, has been earned for the Performance Period. to: (i) designate Participants; (ii) determine the type (iii) determine the calculated in connection with, Awards; (iv) Adjustments. shares subject to outstanding Awards and the Exercise Price or other price of shares of Common 8, 202020, 2020the above company,AtriCure, Inc, and the materials you should review before you cast your vote are now available.ir.atricure.com

202020202023 Annual Meeting of Stockholders to be held on Wednesday,Thursday, May 20, 2020,25, 2023, beginning at 9:00 a.m. EDT. The Annual Meeting will be held online at www.virtualshareholdermeeting.com/ATRC2020.ATRC2023. This proxy statement contains important information regarding the 20202023 Annual Meeting of Stockholders. Specifically, it identifies the matters upon which you are being asked to vote, provides information that you may find useful in determining how to vote and describes the voting procedures.2019,2022, filed with the U.S. Securities and Exchange Commission (SEC); and the term “meeting” means our 20202023 Annual Meeting of Stockholders, including any continuations, postponements or adjournments thereof.8, 2020,10, 2023, we began mailing to our stockholders a Notice of Internet Availability of Proxy Materials (Notice) containing instructions on how to access this proxy statement, the accompanying notice of annual meeting and our annual report for the fiscal year ended December 31, 20192022 online. If you received the Notice, by mail, you will not automatically receive a printed copy of proxy materials in the mail.materials. Instead, the Notice instructs you on how to access and review all of the important information contained in the proxy materials. The Notice also instructs you on how you may submit your proxy via the Internet.20192022 and certain other required information.23, 202027, 2023 (the Record Date) are entitled to notice of and to vote at the meeting and at any continuations, postponements or adjournments thereof. If you are not a stockholder of record but hold shares in street name (that is, through a broker or nominee), you will need to provide proof of beneficial ownership as of March 23, 2020,27, 2023, such as your most recent brokerage account statement, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership.items of business will be voted on at the meeting?The items of business scheduledare my voting rights?on at the meeting are:1.The election of ten nominees to serve as directors on our Board;2.The ratification of the appointment of our independent registered public accounting firmupon, you have one vote for fiscal year 2020; 3.Amending the AtriCure, Inc. 2014 Stock Incentive Plan to increase the number of shareseach share of common stock authorizedyou own as of March 27, 2023. You may vote all shares owned by you as of March 27, 2023, including (1) shares held directly in your name as theissuance thereunder by 900,000 shares; and14.An advisory vote on the compensation of our named executive officersyou as disclosed in this proxy statement. Items to be voted on at meeting Board Recommendation FOR FOR FOR FOR How does the Board of Directors recommend that I vote?Our Board recommends that you vote your shares:1.“FOR” each of the director nominees;2.“FOR” the ratification of our independent registered public accounting firm for fiscal year 2020; 3.“FOR” the amendment of the AtriCure, Inc. 2014 Stock Incentive Plan; and4.“FOR” the approval of the compensation of our named executive officers.What are my voting rights?On each matter to be voted upon, you have one vote for each share of common stock you own as of March 23, 2020. You may vote all shares owned by you as of March 23, 2020, including (1) shares held directly in your name as the stockholder of record and (2) shares held for you as the beneficial owner through a broker, trustee or other nominee such as a bank.23, 2020, 40,079,34427, 2023, 47,392,010 shares of our common stock were outstanding. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum.shareholder,stockholder, there are several ways for you to vote. You may attend the Annual Meeting via the Internet and vote during the Annual Meeting. You may also vote by Internet before the date of the Annual Meeting, by proxy or by telephone, using one of the methods described in the proxy card. Even if you plan to attend the meeting, we recommend that you also submit your proxy card or voting instructions as described below so that your vote will be counted if you later decide not to, or are unable to, attend the meeting.2 director nominees or “WITHHOLD” your vote for any or all director nominees. A properly executed proxy marked “WITHHOLD”“ABSTAIN” with respect to the election of one or more director nominees will not be voted with respect to the director or directors indicated. the affirmative “FOR” vote of a majority of the shares represented virtually or by proxy and entitled to vote will be required. You may vote “FOR”, “AGAINST” or “ABSTAIN” for this item of business. If you “ABSTAIN”, your abstention has the same effect as a vote “AGAINST”.Approval of Amendment to the AtriCure, Inc. 2014 Stock Incentive Plan. For the amendment to the AtriCure, Inc. 2014 Stock Incentive Plan, the affirmative “FOR” vote of a majority of the shares represented virtually or by proxy and entitled to vote will be required. You may vote “FOR”, “AGAINST” or “ABSTAIN” for this item of business. If you “ABSTAIN”, your abstention has the same effect as a vote “AGAINST”.Advisory Vote on Compensation of Named Executive Officers. For the approval, on an advisory basis, of the compensation of our named executive officers, the affirmative “FOR” vote of a majority of the shares represented virtually or by proxy and entitled to vote will be required. You may vote “FOR”, “AGAINST” or “ABSTAIN” for this item of business. If you “ABSTAIN”, your abstention has the same effect as a vote “AGAINST”.“FOR”"FOR" the approval of the AtriCure, Inc. 2023 Stock Incentive Plan, "FOR" the amendment to the AtriCure, Inc. 20142018 Employee Stock IncentivePurchase Plan, “FOR” the approval of the compensation of our named executive officers and in the discretion of the proxy holders on any other matters that properly come before the meeting).20142018 Employee Stock IncentivePurchase Plan), and Proposal 45 (advisory vote on compensation of named executive officers) are not considered routine, brokers holding shares for their customers will not have the ability to cast votes with respect to Proposals 1, 3, 4 and 45 unless they have received instructions from their customers. It is important, therefore, that you provide instructions to your broker if your shares are held by a broker so that your votes with respect to Proposals 1, 3, 4 and 45 are counted. Your broker, therefore, will need to return a proxy card without voting on Proposals 1, 3, 4 and 45 if you do not give voting instructions with respect to these matters. This is referred to as a “broker non-vote”.34.fourfive proposals described in this proxy statement, we are not aware of any other business to be acted upon at the meeting. If you grant a proxy, the persons named as proxy holders, Michael H. Carrel (our President and Chief Executive Officer) and M. Andrew WadeAngela L. Wirick (our Chief Financial Officer), will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If, for any unforeseen reason, any of our nominees are not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by our Board. mailed proxy materials, our directors and employees may also solicit proxies virtually, by telephone, by e-mail or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. We may also engage the services of a professional proxy solicitation firm to aid in the solicitation of proxies from certain brokers, bank nominees and other institutional owners. Our costs for such services, if retained, will not be material.42021 (20212024 (2024 Annual Meeting), the written proposal must be received by the Secretary of AtriCure at our principal executive offices no earlier than November 9, 202012, 2023 and no later than December 9, 2020.12, 2023. However, if the date of our 20212024 Annual Meeting changes by more than 30 days from the date of the meeting, then your notice must be received no later than the close of business on the later of (i) the 150th day prior to the date of the 20212024 Annual Meeting or (ii) the 10th day following the date we make a public announcement of the date of the 20212024 Annual Meeting. Any notices delivered outside of these dates shall be considered untimely. Such proposals must provide the information required by our Bylaws and also must comply with the requirements of Regulation 14A of the Securities Exchange Act of 1934 and any other applicable rules established by the SEC. Proposals should be addressed to:9, 202012, 2023 and no later than December 9, 2020.13, 2023. In order to comply with the universal proxy rules, stockholders who intend to solicit proxies for the 2024 Annual Meeting in support of director nominees other than AtriCure's nominees must provide notice to AtriCure that sets forth the information required by Exchange Act Rule 14a-19 not later than March 25, 2024.tennine directors: Michael H. Carrel, Mark A. Collar, Scott W. Drake, Daniel P. Florin, Regina E. Groves, B. Kristine Johnson, Mark R. Lanning, Karen N. Prange, Deborah H. Telman, Sven A. Wehrwein, and Robert S. White and Maggie Yuen, each of whose terms expire at this meeting. Ms. PrangeMr. Florin were appointed by our Board to serve as directors effective December 4, 2019.Mark A. Collar, Scott W. Drake, Daniel P. Florin, Regina E. Groves, B. Kristine Johnson, Mark R. Lanning, Karen N. Prange, Deborah H. Telman, Sven A. Wehrwein, and Robert S. White.White and Maggie Yuen. If elected, these nominees will hold office as directors until our 20212024 Annual Meeting and until their respective successors are elected and qualified or until their earlier death, resignation or removal.Committee Membership Name Age Director Since Independent Audit Compensation Compliance, Quality, and Risk Nominating and Corporate Governance Strategy Michael H. Carrel 52 2012 No Regina E. Groves 64 2017 Yes X* C X B. Kristine Johnson 71 2017 Yes X X Karen N. Prange 59 2019 Yes C X Deborah H. Telman 58 2021 Yes X X Sven A. Wehrwein 72 2016 Yes C* X Robert S. White 61 2013 Yes X C C Maggie Yuen 51 2021 Yes X* rules+ = Effective February 21, 2020, Ms. Prange joined the Compensation and Nominating and Corporate Governance Committees, and Mr. Florin joined the audit and Compliance, Quality, and Risk Committees. Ms. Johnson’s service on the Audit Committee ended effective April 1, 2020.23, 2020.27, 2023. The primary experience, qualifications, attributes and skills of each director nominee that led to the conclusion that such nominee should serve as a member of the Board of Directors are also described below.served asbeen President, Chief Executive Officer and director since November 2012. Since joining AtriCure, Mr. Carrel has fostered a patient-first company approachmission by focusing on the three core areas: innovation, clinical science and education. This strategic approach has led AtriCure to significantly invest in the development of a pipeline of novel products and groundbreaking clinical trials for the treatment of atrial fibrillation (Afib), left atrial appendage management and pain management;management, and continue to expand its market presence within Europeglobally. These investments have driven significant growth in AtriCure's revenue from $82 million in 2013 to $330 million in 2022, and Asia; and grow the global employee baseallowed us to help over 139,000 patients worldwide in 2022. Further, market cap has increased from 200$115 million to over 700 employees.approximately $2 billion at December 31, 2022 under his leadership. In addition, during Mike’sMr. Carrel's tenure, AtriCure has acquired three companies, Estech, nContact, and SentreHEART, adding leading ablation and appendage management technologies to further AtriCure’s market position worldwide.served aswas President and Chief Executive Officer of Vital Images, Inc., a publicly-traded medical imaging software company thatwhich was successfully sold to Toshiba in 2011.Medical Systems Corporation. Prior to Vital Images,a privately-held provider of non-line-of-sight plug and play broadband wireless access systems. Inc., which also had successful acquisition exits.recentlyis Board Chair of Axonics, Inc., a publicly traded company and global leader in medial devices for incontinence therapies, and he has served as a directoron the Board of Lombard Medical until acquired by MicroPort Scientific Corporation in 2018.Axonics since 2019. Mr. Carrel currently servesis also the Chair of Big Brothers Big Sisters of America and has served on the boardBoard since 2021, and he has served on the Board of the Medical Device Manufacturers Association (MDMA) and Axonics Modulation Technologies, Inc. a medical device company focused on the treatment of urinary and6bowel dysfunction.since 2017. Mr. Carrel holds a B.S. in Accounting from The Pennsylvania State University and an M.B.A. from The Wharton School at the University of Pennsylvania.Carrel’sCarrel has significant experience in positions advising and overseeing strategic development and management of rapid growth. His extensive understanding of our business, operations and strategy, as well as the medical device industry experienceand competitive landscape qualify him to serve on our Board of Directors.Mark A. Collar. Mr. Collar has served as one of our directors since February 2008. Mr. Collar is the owner of Collar, Ltd., an investment and consulting business. Mr. Collar retired in 2008 as an officer within the Procter and Gamble Company where his roles included President of the Global Pharmaceuticals and Personal Health business. Mr. Collar joined Procter and Gamble in 1975 as a sales representative, then moved into advertising, and subsequently assumed roles of progressive responsibility within the Health and Personal Care, Beauty Care, New Business Development, Pharmaceuticals and Personal Health Care Products divisions over his 32-year career. Mr. Collar recently served as a director of First Financial Bancorp; Enable Injections, a privately-held start-up company focusing on high volume injection devices for biologic drugs; and as Chairman and Director of Marketing at TTRC, LLC (Invisible Ink Tattoo Removers), a national tattoo removal chain. Mr. Collar also serves in director and advisory roles in several philanthropic, academic and economic development organizations. Mr. Collar received his B.S. from Northern Illinois University.Mr. Collar brings a wealth of knowledge from his 32 years at Procter and Gamble, including marketing, competitive analysis, operations, mergers and acquisitions, financial management, sales corporate strategy, risk management, regulatory, and quality control. Mr. Collar’s leadership roles in a number of organizations, including his prior membership on the board of another publicly traded company, provide us with insights into a number of opportunistic fields as well as dealing with government officials and agencies, executive compensation and corporate governance matters. Scott W. Drake. Mr. Drake has served as one of our directors since September 2013 and as the Chairman of the Board since May 2018. Mr. Drake currently serves as the President and Chief Executive Officer of ViewRay, a publicly-held medical device company with global operations in radiation therapy and imaging technologies. Previously, Mr. Drake was the President, Chief Executive Officer, and member of the Board of Directors of The Spectranetics Corporation from 2011 to 2017. Spectranetics, acquired by Royal Philips in August of 2017, was a publicly-held medical device company that developed, manufactured and distributed single-use medical devices used in minimally invasive procedures within the cardiovascular system. Prior to joining Spectranetics, Mr. Drake served as Senior Vice President, Operations, of DaVita, Inc., a leading U.S. provider of kidney care and dialysis. Previously, Mr. Drake spent 17 years in several leadership positions within numerous healthcare business units at Covidien. From 2006 to 2009, he was President of Covidien’s Respiratory and Monitoring Solutions Global Business Unit, a $1.5 billion business with 8,000 employees. Mr. Drake has also served on the Board of Directors for The Zayo Group Holdings, Inc. since November 2018. Mr. Drake is Chairperson of the AdvaMed Radiation Therapy Sector and a board member of the Medical Device Manufacturers Association (MDMA). Mr. Drake earned a B.S. in Business Administration from Miami University of Ohio.Mr. Drake’s significant leadership experience in the medical device industry provides him insight into the high-level corporate governance, executive compensation, regulatory (including FDA) and business management matters that the Company and the Board consider on a regular basis and gives him skills which the Board considers as valuable for evaluating and improving the Company’s competitive position and serving as Chairman of the Board of Directors.Daniel P. Florin. Mr. Florin has served as one of our directors since December 2019. Mr. Florin most recently served as Executive Vice President at Zimmer Biomet Holdings, a publicly-held global leader in musculoskeletal healthcare until March 2020. He was appointed to his position in July 2019 upon announcing his intention to retire from the company. Previously he served as Executive Vice President and Chief Financial Officer of the company from June 2015 to July 2019. In addition, he served as Interim Chief Executive Officer of the company from July 2017 to December 2017. Prior to working at Zimmer Biomet, Mr. Florin was Chief Financial Officer for Biomet, Inc. until the company merged with Zimmer, Inc. and became Zimmer Biomet Holdings. Prior to working at Biomet, he held various roles at Boston Scientific, Inc., CR Bard, Inc. and Deloitte & Touche, LLP. Mr. Florin has served on the Board of Directors of Pulmonx since January 2020. Mr. Florin received an undergraduate degree from the University of Notre Dame and earned his M.B.A. from Boston University Executive MBA program.Mr. Florin’s knowledge of the healthcare industry, proficiency in evaluating mergers and acquisitions, and significant experience as a chief financial officer and independent public accountant provides valuable skills to the Board. Mr. Florin qualifies as an “audit committee financial expert” under SEC rules.the Chief Operating Officer and a board member of Stimwave Technologies,the Board of Directors of Fulgent Genetics, Inc., a publicly traded company that provides technology-based genetic testing and therapeutics, and Advanced NanoTherapies, Inc., a privately held medical device company. company addressing challenges of vascular disease. Most recently, Ms. Groves was theheld multiple interim leadership roles at Stimwave, LLC, including Chief Financial Officer and Chief Operating Officer. Ms. Groves also served as a director at Stimwave, LLC from July 2019 to December 2022. Before her roles at Stimwave, LLC, Ms. Groves served as Chief Executive Officer at REVA Medical, Inc., from 2015 to 2019, a formerly publicly-traded medical device company focused on the development and commercialization of bioresorbable polymer technologies for vascular applications from September 2015 to March 2019.applications. Prior to joining REVA Medical, Ms. Groves served asshe held multiple positions at Medtronic, Inc., a leading global medical technology company from 2002 to 2015. As Vice President and General Manager of the AF Solutions, Cardiac Rhythm and Heart Failure division, of Medtronic, Inc., a leading global medical technology company. In this position, she successfully developed and executed strategies to7As a seasoned executive in the medical device industry, has significant leadershipis an expert in enterprise risk assessment and mitigation and possesses functional experience managing growing businesses, achieving sustainable revenue growth, driving operational improvementsin strategy, finance, sales, Afib, manufacturing operations and managing quality and regulatory (including FDA)marketing matters which the Board considers as valuable skills for evaluating and improving the Company’s competitive position as well as supporting the functions of the Board’s Compliance, Qualityvarious committees. Ms. Groves holds a CERT Certificate in Cybersecurity Oversight and Risk Committee and Strategy Committee.investshas invested primarily in seed and early-stage health care companies in the United States. She has held this positionStates, since 2000. Prior to joining Affinity Capital Management, in 1999, Ms. Johnson was Senior Vice President and Chief Administrative Officer of Medtronic, Inc. During her seventeen years at Medtronic, she also served as President and General Manager of its vascular business and President and General Manager of its tachyarrhythmia management business. She currently serves as a director for several publicly traded med-tech companies: ClearPoint Neuro, Inc., formerly MRI Interventions.Interventions, ViewRay, Inc. and Paragon28, Inc. She also serves as the board chair ofa director for the University of Minnesota Foundation Investment Advisors, as well as serving on the boards of several private entities.Advisors. She previously served as lead director on the Board of Directors of Piper Jaffray (now Piper Sandler), a publicly-held middle market investment bank and asset management firm. Her previous public board experience also includes service on the Boards of Directors of Spectranetics, Corporation,Inc., which was acquired by Philips,Royal Philips; ADC Telecommunications, Inc. which was acquired by Tyco Electronics,Electronics; and Pentair.Pentair, Inc. In 2018, Ms. Johnson was a National Association of Corporate Directors (NACD) Directorship 100 Honoree. Ms. Johnson received her B.A. from St. Olaf College.particularly its Strategy, Compensation and Audit Committees, with valuable insights and knowledge, both from a client and public company perspective, particularly in matters related to mergers and acquisitions, transactions, executive compensation, corporate governance and financial reporting.Mark R. Lanning, C.P.A. Mr. Lanning has served as one of our directors since February 2006. Mr. Lanning currently is a financial consultant and a principal of the Lanning CPA Group. Previously Mr. Lanning served as Vice President-Finance and Chief Financial Officer of Frisch’s Restaurants from 2011 to 2016. During his tenure with Frisch’s, Mr. Lanning led the process of transforming then publicly-traded Frisch’s to a privately-held company which included the strategic disposition of major operations. Prior to joining Frisch’s, Mr. Lanning served in various roles, including Vice President, Investor Relations Officer and Treasurer of publicly-traded Hillenbrand, Inc., Hill-Rom, Inc. and Hillenbrand Industries, diversified leaders in the healthcare equipment, funeral services, and material handling industries. Mr. Lanning also spent twelve years in increasing positions of responsibility with Ernst & Whinney (now EY). Mr. Lanning, a Certified Public Accountant, is a past member of the Governing Council of the American Institute of CPAs (AICPA), is a past Chairman and Board member of the Indiana CPA Society and has served on the boards of several charitable and educational institutions over the years. Mr. Lanning received his B.S. in Accounting from Ball State University.As a Certified Public Accountant, Mr. Lanning developed significant experience in preparing, auditing and evaluating financial statements and dealt with broad strategic and complex financial, accounting and reporting issues comparable to those of the Company, which qualifies him as an “audit committee financial expert” under SEC rules. His experience as an executive officer of public companies has given him significant experience in executive compensation matters.and a member of the Executive Committee.Inc.from 2016 to 2018. In this role, she led a business that generated over $6 billion of revenue across three different business units, growing the business to above-market levels in all business segments. Prior to her role at Henry Schein, she led the Urology and Pelvic Health business for Boston Scientific, Inc. from Ms. Prange serves on the boards of Cantel Medical Corp., Nevro Corp. and WSAudiology and is a strategic advisor of Nuvo Group Ltd. Ms. Prange earned her B.S. in Business Administration with honors from the University of Florida and has completed executive education coursework at UCLA Anderson School of Business and Smith College.BoardBoard.its Compensation Committee. During his 35-plus yearsWith more than three decades in accounting and finance, Mr. Wehrwein has8the Chairmana member of the Board of Directors of Proto Labs, Inc., a custom prototype manufacturer and as a member of the Board of Directors of SPS Commerce, Inc., a supply-chain management software company, both of which are publicly-traded companies. Mr. Wehrwein has also previously served on the boards of directors for a number of other medical device and high growth companies including tenures on the boards of Cogentix Medical, Inc., Compellent Technologies, Inc., Synovis Life Technologies, Inc., Vital Images and Vital Images.Nonin Medical, Inc. Mr. Wehrwein holds a B.S. in Business from Loyola University of Chicago and an M.S. in Management from the Sloan School, MIT.Mr. Wehrwein’s qualifications to serve on our Board of Directors include, among other skills and qualifications, his capabilities in financial understanding, strategic planning and auditing expertise, givenpositions.positions, Mr. Wehrwein’s capabilities in financial understanding, strategic planning, corporate governance, mergers and acquisitions, and auditing expertise qualify him to serve on our Board of Directors. As ChairmanChair of the Audit Committee, Mr. Wehrwein also keeps the board abreastBoard informed of current audit issues and collaborates with our independent auditors and senior management team. Mr. Wehrwein qualifies as an “audit committee financial expert” under SEC rules.operating partnerOperating Partner of EW Healthcare Partners since May 2018. Most recently,Previously, Mr. White served as President and Chief Executive Officer of Entellus Medical, Inc., which was acquired by Stryker Corporation in February 2018, a publicly-traded company that delivered innovative, high quality, minimally-invasive therapeutic solutions to healthcare providers and their patients who suffer from sinusitis. Entellus was acquired by Stryker Corporation in February 2018. Prior to joining Entellus, Mr. White served as President and CEO of TYRX, a privately-held company acquired by Medtronic, Inc. TYRX commercialized innovative, implantable combination drug and device products focused on infection control. Prior to joining TYRX, Mr. White held several senior leadership positions with Medtronic, Inc. Mr. White served as, including President of Medtronic Kyphon following its $3.9 billion acquisition of the spinal treatment business. During his time with Medtronic, Mr. White also served asbusiness; President of Physio ControlControl; and was responsible for commercial operations of the Cardiac Rhythm Disease Management business as Vice President of U.S. Sales and Global Marketing. Earlier in his career, Mr. White held positions with General Electric Company and Eli Lilly and Company, among others. Mr. White recentlycurrently serves on the Board of Directors of TissueTech, Inc., a privately held parent company of Bio-Tissue, Inc. and Amniox Medical, Inc., that pioneered the development and clinical application of human birth tissue-based products. Mr. White also currently serves on the Board of Directors of Vital Connect, a privately-held company that develops and markets wearable biosensor technology for wireless patient monitoring, and Cardiac Dimensions, a privately-held company that develops and markets treatment modalities to address heart failure and related cardiovascular conditions. Mr. White has served on the Board of Directors of multiple bio-medical/medical device companies, including Cardiva Medical (acquired by Haemonetics Corp. in February 2021), HyperBranch Medical Technology a privately-held company that develops and markets products capable of adhering tissues, promoting healing, preventing fluid and air leaks, and reducing infections, until it was acquired(acquired by Stryker Corporation in October 2018. Mr. White also served on the Board of Directors of2018) and Novadaq a publicly-traded provider of clinically relevant imaging solutions for use in surgical and diagnostic procedures, until it was acquired(acquired by Stryker Corporation in June 2018.2018). Mr. White holds a B.S. in Aerospace Engineering from the University of Missouri-Rolla and an M.B.A. from Cornell University.AtriCure, particularly through his leadershipAtriCure.Board’s Strategy Committee,manufacturing, medical devices and enhancelife science industries. Over the Board’s capacitiescourse of her career, she has developed financial and operational expertise at both multi-billion dollar public companies and entrepreneurial start-up ventures. Prior to her service with Penumbra, she was Vice President of Finance and Divisional Chief Financial Officer for the Genetic Science Division for Thermo Fisher Scientific Inc. from 2016 to 2019 and was Chief Financial Officer at Mirion Technologies from 2014 to 2016. She has also held various roles at Boston Scientific, GLU Mobile, Lifescan Inc., Picker International, Rockwell Automation and Eaton Corporation. Ms. Yuen received her B.A.Sc. in business development initiatives, regulatory complianceAccounting, Masters of Accountancy and corporate governance.ChairmanChair positions. Mr. DrakeMs. Johnson serves as our Chairman of the Board and presidesChair, presiding over Board meetings and providesproviding the Company with the benefit of hisher appreciation for and understanding of the risks associated with the Company’sCompany's business, andas well as an intimate knowledge of the Company’s technologies and the medical device industry. Mr. Carrel serves as our President and Chief Executive Officer and provides the Company with the benefit of his strategic and creative vision, an extensive knowledge of the Company’s operations, an understanding of the day-to-day challenges faced by companies in the medical device industry and his business and financial know-how.ChairmanChair and Chief Executive Officer roles enhances appropriate oversight of management by the Board, Board independence, the accountability to our stockholders by the Board and our overall leadership structure. Furthermore, the Board believes that maintaining separation of the ChairmanChair function from that of the Chief Executive Officer allows the Chief Executive Officer to properly focus on managing the business, rather than requiring a significant portion of his efforts to be spent on also overseeing Board matters.Initiativeengaging in a Board refreshment initiative.2012, the Company began examining board membership. A formal refreshment initiative began in 2016, recognizing that six members had served on the Board for ten or more years. The Nominating and Corporate Governance Committee usedcontinues to use the Board and Committee evaluation processes to address the Board refreshment initiative and also consideredconsiders diversity a priority. The National Association of Corporate Directors (NACD) recognized us as the priority of diversity. In December 2019, we expanded the sizewinner of the Board to ten members, announcing2022 Diversity, Equity & Inclusion Award in the appointmentSmall Cap - Public Company category. This award recognizes boards that have improved their governance and created long-term value for stakeholders by implementing forward-thinking diversity, equity, and inclusion practices. We believe that the diversity of Daniel P. Florin and Karen N. Prange to theour Board of Directors.10Board Diversity Matrix as of December 31, 2022 Board Size: Total Number of Directors 9 Gender: Male Female Non-Binary Gender Undisclosed Number of directors based on gender identity 4 5 — — Number of directors who identify in any of the categories below: African American or Black — 1 — — Alaskan Native or American Indian — — — — Asian — 1 — — Hispanic or Latinx — — — — Native Hawaiian or Pacific Islander — — — — White 4 3 — — Two or More Races or Ethnicities — — — — LGBTQ+ — Undisclosed — 90% 10% 70% 30% 30% 20% 50% 50% 30% 20% Strategy StrategyFDA FDAGrowth Companies & Investment InvestmentCorporate Governance Human Capital Management Cybersecurity Oversight IndependenceNasdaq StockNASDAQ Global Market (Nasdaq)(NASDAQ) listing standards require that a majority of the members of a listed company’s board of directors qualify as “independent”, as affirmatively determined by the board of directors. OurCurrently, our Board consists of the following tennine directors: Scott W. Drake (Chairman), Michael H. Carrel, Mark A. Collar, Daniel P. Florin, Regina E. Groves, B. Kristine Johnson Mark R. Lanning,(Chair), Karen N. Prange, Deborah H. Telman, Sven A. Wehrwein, and Robert S. White.White and Maggie Yuen. Our Board has affirmatively determined that each of the directors and nominees, other than Michael H. Carrel, our President and Chief Executive Officer, is independent under the listing standards established by Nasdaq.NasdaqNASDAQ listing standards, our non-management directors meet in regularly scheduled executive sessions at which only independent directors are present.MeeDuring 2019, the Board held seven meetings. The Audit Committee held five meetings, the Compensation Committee held six meetings, the Compliance, Quality and Risk Committee held six meetings, the Nominating and Corporate Governance Committee held four meetings and the Strategy Committee held four meetings.Our directors are strongly encouraged to attend the Company’s annual meeting of stockholders. All of our directors attended the 2019 Annual Meeting. All of our directors attended at least 75% of the aggregate of all Board meetings and meetings of Committees on which such directors served during 2019.Committees of the BoardAudit Committee. Our Audit Committee is responsibleoverseeing our financial controls, annual auditeach committee. The table on page 6 and financial reportingthe notes thereto describe changes in membership and reviewschair positions effective as of the effectivenessdate of our internal control over financial reporting and accounting and reporting practices and procedures with our management and our independent registered public accountants. In addition, this Committee reviews the qualifications of our independent registered public accountants, is responsible for theirAnnual Meeting.Committee Members Key Responsibilities and oversight and oversight of our independent registered public accounting firm; reviews the scope, fees and results of activities related to audit and non-audit services.NasdaqNASDAQ rules and the independence requirements of the SEC. Our Board has also determined that Daniel P. Florin, Mark R. Lanning andRegina E. Groves, Sven A. Wehrwein, and Maggie Yuen each qualify as an “audit committee financial expert”, as defined in SEC rules.11Compensation Committee. The Compensation Committee’s principal responsibility isOur directors are strongly encouraged to assist the Board in overseeingattend the Company’s management compensation policies and practices. Responsibilities include determining and approving the compensationannual meeting of stockholders. All of our Chief Executive Officer; reviewing and approving compensation levels fordirectors attended the 2022 Annual Meeting. All of our other executive officers, reviewing and approving management incentive compensation policies and programs; reviewing and approving equity compensation programs for employees and exercising discretion in the administration of those programs; reviewing with management our disclosures under “Compensation Discussion and Analysis,” or CD&A, and producing an annual report on executive compensation that contains a recommendation with respect to inclusiondirectors attended at least 75% of the CD&A in our filings with the SEC. The compositionaggregate of theall Board meetings and meetings of Committees on which such directors served during 2022. Committee satisfies the independence requirements of Nasdaq.Compliance, Quality and Risk Committee. The Compliance, Quality and Risk Committee is responsible for providing ongoing oversight over our Code of Conduct, compliance with applicable U.S. Food and Drug Administration and international requirements and other compliance activities which present significant regulatory risk to us, assisting the Board in evaluating the effectiveness of our compliance program, overseeing the Company’s quality systems and overseeing compliance, legal and enterprise risk management and control activities. The composition of the Compliance, Quality and Risk Committee satisfies the independence requirement of Nasdaq.Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for reviewing and making recommendations on the composition of our Board and selection of directors, periodically assessing the functioning of our Board and its committees and making recommendations to our Board regarding corporate governance matters and practices. The composition of the Nominating and Corporate Governance Committee satisfies the independence requirements of Nasdaq.The Nominating and Corporate Governance Committee also is responsible for ensuring there is an effective succession plan for the Company’s CEO. Our succession plan addresses a short-term or unexpected loss of our CEO, and the Nominating and Corporate Governance Committee annually discusses long-term executive succession.Strategy Committee. The Strategy Committee is responsible for assisting the Board in carrying out its oversight responsibilities relating to potential mergers, acquisitions, divestitures, joint ventures and other key strategic transactions outside the ordinary course of the Company’s business, in each case other than any transaction involving a sale or change of control of the Company. The composition of the Strategy Committee satisfies the independence requirements of Nasdaq.years. The peer group used is consistent with the peer group used to benchmark the compensation of the Company’s executive officers. There were no changes to the director compensation program in 2019. During 2019 we paid an annual retainer, to our non-employee directors of $50,000. We also paid an additional $50,000 retainer to the Chairman of the Board.three years. Each non-employee director receives additional retainers for service as follows:Director Compensation Annual Cash Retainer $ 50,000 Additional Cash Retainer to Chair of the Board 50,000 150,000 Committee Membership Retainer Audit $ 20,000 $ 10,000 Compensation 15,000 7,500 Compliance, Quality and Risk 15,000 7,500 Nominating and Corporate Governance 10,000 5,000 Strategy 10,000 7,500 committees as follows:date of the annual meeting of stockholders, with the number of shares determined by dividing the annual retainer by closing stock price on the annual meeting date. The annual grant vests in full on the one-year anniversary of the grant date. The annual stock retainer was increased from $125,000 to $150,000 in 2022.20,000 10,000 15,000 7,500 10,000 7,500 10,000 5,000 10,000 7,500 (1)(2)Includes committee membership retainer.grant. In addition,grant and vesting annually over a three-year period in lieu of the annual grants to non-employee directors are approximately $125,000 of restricted stock immediately after eachretainer. All Board members elected at a subsequent annual meeting of stockholders if such person is serving as a non-employee director at such time either by virtue of being re-elected. The annual grants are valued atgranted the closing price on the date of the annual meeting of stockholders. The annual grants generally will vest in full on the one-year anniversary of the date of grant, and the initial grants will generally vest annually over a three-year period. Annual Stock Retainer.122019.2022.

or Paid in

Cash ($)67,500 124,978 192,478 105,000 124,978 229,978 3,804 174,994 178,798 72,500 124,978 197,478 75,000 124,978 199,978 75,000 124,978 199,978 3,804 174,994 178,798 77,500 124,978 202,478 72,500 124,978 197,478 Name Fees Earned or